Incorporated ERP banking Software conveys client expected encounters and changes your strategic policies to operational greatness. ERP usage in the financial industry is an extraordinary advancement towards growing your business as it offers better productivity, client experience, and consistency adherence.

Monetary enterprises started using ERP software in the mid-2000s. Presently, a few banks utilize essential frameworks with somewhat changed modules, yet more organizations relocate to adjustable items that suit current requests for security, information preparing, and cash control.

The Popularity of ERP Software

ERP programming overall is assessed to arrive at an income of 48.21 billion USD by 2025. This is a huge development pace of 7.88% CAGR from 2021. In 2020, ERP usage got perhaps the best practice worldwide that brought and robotized the whole business activities into a straightforward and single arrangement. The cloud application spending is relied upon to arrive at 227 billion USD while cloud administrations are required to arrive at 70 billion USD by 2022.

A review on ERP clients was led universally that demonstrated 64% of the organizations use SaaS, 21% percent use Cloud ERP, and the excess 15% use on-premises. The arrangements of Cloud represent about 44% of usage for respondents in the conveyance and assembling areas.

What is ERP and Why does the Banking Industry Need ERP?

ERP (Enterprise Resource Planning) frameworks address the most mainstream way to deal with the in-house business measures and to assemble, store, and decipher the information. Business visionaries appreciate ERP in the banking industry.

ERP in the finance industry conveys a whole range of money arrangements and administrations. ERP programming utilized in banks incorporates a scope of direct arrangements toward enormous organizations with a mix of ERP in the finance area. These empowered arrangements change banking and financial help foundations into present-day ventures, which helps in adjusting to new or forthcoming business measures and grow without any problem.

ERP is the best approach to join all fundamental business measures in a solitary ground-breaking framework. An ERP Software Development Services furnishes representatives with an adaptable yet less mind-boggling IT design to adapt to work-related exercises faster. Here are some advantages of utilizing such financial administration programming.

1. Increased Efficiency

All financial cycles are coordinated in one stage. Simple and quick admittance to all information required across the entire bank and all the offices. Everyday tasks, for example, making reports or filling in the information, are now computerized with an ERP software service. It is conceivable to survey the fundamental KPIs on a dashboard also with the goal that chiefs can rapidly flick through it. ERP additionally kills the monotonous working cycles.

2. Smooth Collaboration

ERP in banking empowers viable and smooth coordinated efforts between partners from various divisions. Besides, an ERP framework encourages the joint effort with far off groups. A seaward or nearshore group will be accessible inside a couple of snaps to guarantee the beneficial work process.

3. Increased Data Security

An ERP framework offers firewalls to bring down the dangers of information breaks. You will get one information distribution center and all passages will be effectively observed and the security level will be a lot higher. It will be conceivable to limit the entrance of fired workers and offer admittance to recently recruited IT workers. An ERP framework permits the identification of unapproved or dubious exercises as all financial exercises will be accessible to the administrator.

4. Reduced Operational Costs

An ERP Software Development Company can likewise help you save money on operational expenses and cut down the financial plan. All cycles are smoothed out and observed, accordingly, the possible breakdowns or interruptions will be forestalled or immediately dispensed with. Tending to any happening issues will be a lot simpler and quicker and this empowers to save money on operational consumptions.

5. Strict Compliance with Regulations

The banking area should deal with and consent to different industry rules and guidelines. An ERP for industry arrangement joins administrative guidelines and reports on consistency to help banks meet these severe prerequisites easily.

6. Easy access to Financial Data

It is sufficient to enter data once to make it accessible for everybody with consent. Such information comes without additional modifications. The investigation dashboard and GL will give approved clients all they require to think about your association’s financials. From exchange to a spike in deals, you will consistently realize what is happening inside your financial area at that definite second.

7. Communication between Branches

ERP programming for the banking industry interfaces all offices and encourages work processes. The computerized design forestalls losses or losing records, and they will consequently be documented into the legitimate spot. On the off chance that you choose a cloud-based framework, you will want to get to your financial tools at any place, whenever required. Records payable will inform you of impending installments, or you could decide to have them taken out naturally.

8. Control and Monitoring

While everything is followed by machines, it gets easy to check staff execution of business cycles’ present statuses. Monetary ERP Software for banking modules incorporates other business frameworks, for example, CRM, which will give deals numbers and showcasing financial plans. The GL is the primary center; you can get to all your organization’s financial data in one spot.

9. Fewer Human-related Errors

The worldwide biological system disposes of the chance of missing exchanges, failed to remember records or specialized mutilations. Bookkeeping missteps, for example, information passage mistakes are normal yet can be recognized and kept away with the assistance of ERP financial programming.

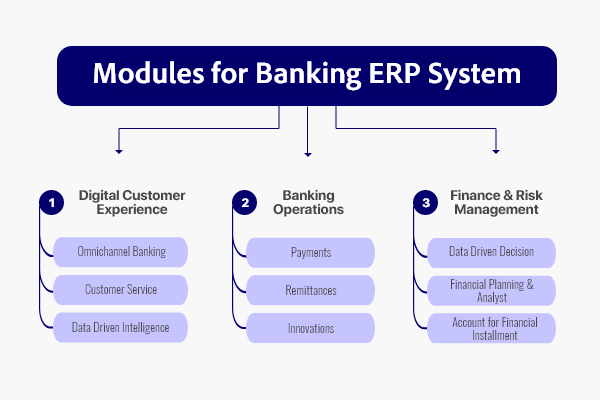

Must Need Modules for ERP in Banking

* Profit Tracking

An essential capacity of ERP software for finance modules is profit tracking. The profit tracker will give a bird’s-eye perspective on how the business is utilizing its financial assets and its general financial well being. Following your benefits will show you where most benefits are coming from, while likewise deciding the quantifiable profit for any purchase.

The tracker utilizes the brought about expenses and any receivables to ascertain how much your association is benefiting from your endeavors. On the other side, financial administration programming can likewise help organizations track costs.

The ideal idea of these kinds of instruments is to make changes that will expand benefits for a business. Consider financial administration programming giving a guide to business pioneers who comprehend the best moves in their present business conditions.

* Ledger Management

Ledger management is another crucial capacity of the ERP in the banking and finance framework. An overall record gives an intensive record of every single financial exchange. It incorporates the entirety of your other ERP system.

Sections are normally made straightforwardly into the overall record (GL), however, your framework may permit you to change passages anyplace inside the application. In any case, you will want to see your entrances in a single focal area. You can monitor an assortment of things, for instance, resources, liabilities, capitol records, pay, and costs.

Having all your financial information in one spot can make recording assessment forms more reasonable and help you from overspending. You can rapidly distinguish any odd exchanges or misrepresentation, and a few frameworks will naturally advise you of these occurrences.

* Accounts Payability

Account payability will deal with all the subsidiaries your organization owes to your sellers and different banks. The account payability component incorporates your payable information with your buying framework so you can assume responsibility for your incomes.

AP robotization saves you $16 per receipt or more, contingent upon the size of your organization. The framework will want to rapidly deal with a lot of solicitations and other financial exchanges between your organization and sellers. A few applications offer report catches which will change over paper solicitations into electronic archives.

To put it plainly, an Accounts payability in Best banking software will tell the client the amount they owe and when it is expected, so you won’t ever be late on an installment again.

* Records Receivability

Records receivable permits your business to deal with all the asset’s clients owe them. It will follow client installments just as oversee solicitations and money.

A few Banking system software offer an entrance for your clients where they can make installments or access solicitations. You can computerize assignments, for example, sending installment updates or record explanations, and creating repeating solicitations.

AR computerization speeds up the assortment cycle and will support client connections since the simplicity of installment makes your association more available.

* Fixed Asset Management

This arrangement tracks and deals with the entire organization’s substantial resources, for example, fabricating hardware, PCs, organization vehicles, and office space. It will think about devaluation figurines, consistent prerequisites, and assessment suggestions.

Resource the board gives your association better permeability regarding use, expenses, and support. For instance, monitoring the devaluation of your resources can help you conjecture consumptions and make spending plans. If you know that your hardware may require an update soon, you can design as needed for those installments.

Following your resources will keep you from paying duties on things that you have dispensed with or supplanted, which is a simple mix-up that can happen while attempting to keep up your records. The device will likewise see openings for deals to charge investment funds — a few wards give tax reductions, or exclusions, to explicit enterprises.

* Risk Management

Risk management instruments can anticipate, dissect and oversee emergencies. These circumstances can happen anywhere from financial issues to even catastrophic events.

Other potential catastrophes that can be dealt with Risk management arrangements could be identified with security, legitimate liabilities, consistency, or reputational chances. Consistency guidelines can be trying to monitor since they are always showing signs of change.

From a financial perspective, it will screen any cash streaming through your business. Your risk management tool can guarantee that you have sufficient money stores to cover creditor liabilities if a client misses an installment; this oversees credit hazard.

* Reporting

The investigation gives continuous admittance to financial information, which is essential for keeping up your funds. The permeability causes you to settle on information-driven expectations and choices concerning your organization’s accounts.

On an essential level, revealing and investigation will show you where income is being produced and where it isn’t being created. The dashboard can accomplish such a great deal, for example, show your deals, anticipated deals, costs, and numerous other financial segments.

Ordinarily, the dashboard is adjustable, so you can pick which classifications you might want to see. Information appears in diagram design which permits you to rapidly comprehend the financial wellbeing of your organization at that careful second.

* Tax Management

Tax arrangements are stored in Core banking software tax collection settings and give charge review and duty announcing capacities. Tax assessment settings ought to be utilized across the framework to give a reliable assortment of deals and VAT charges.

Tax managers will finish the dreary errand of deciding deals using pre-built charge insight to handle deal exchange consistency with appropriate guidelines.

The capacities of your tax management rely upon which framework you buy, and the framework you buy will rely upon the necessities of your organization. In any case, utilizing a tax manager inside your association is an incredible method to try not to invest energy in everyday assignments.

How to Build a Banking and Financial ERP System?

Here are the steps of building a banking and financial ERP System:

Steps 1- Analysis and Planning

At this stage, key individuals are recognized who are generally acquainted with the organization or its division where the task will be executed. They assemble and figure the objectives and goals of the ERP: what cycles will be mechanized, which jobs are required, what will be in the data set, and such.

Steps 2- User Friendly Designing

The useful, plan, and utilitarian detail of the framework is created: the engineering is chosen, the wire frames are created, the equipment prerequisites are indicated, the arrangement of authoritative estimates essential for the execution of the framework is resolved, just as the rundown of records administering its utilization.

Steps 3- Development Phase

IT engineers investigate the associations between every module, apparatus, capacity, and plan component and plan the comparing design. Old information is changed over to the arrangement needed by the new ERP. Data sources are resolved and framework client job layouts are made.

Steps 4- Testing

Made programming is checked for bugs, glitches, plan blunders. It likewise checks the precision and culmination of the information base, the presentation of the framework in general, and of every individual thing. Identified issues wipe out and afterward continue to the tests. Staff preparation is completed.

Steps 5- Deployment

At the point when the framework is tried and the staff figures out how to function unquestionably and rapidly on another ERP, the product is brought into the workplace. To begin with, on a limited scale: a combination into the work process of a different unit. In the case of all is great, the ERP framework is coordinated into all business cycles of the organization.

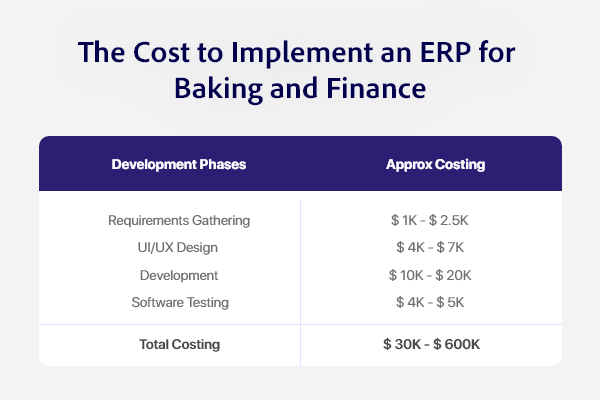

How Much Banking ERP Implementation Costs?

ERP is the need of the hour for Banking and Finance businesses and the benefits of implementing this technology lures everyone. But understanding the resources and cost of implementing ERP in banking and finance is very crucial. Here are the areas of costings

1. Requirements Gathering – This phase involves understanding the need of ERP and finding out expectations of stakeholders. The Cost goes around $1000-$2500

2. Planning and Design – Once the team knows, what is needed. It’s time to locate the resources and plan out the process with help of architects and Chief Technical Officers. It costs around $4000-$7000

3. Development Phase: Actual implementation of the plan begins here. All the components are developed and then combined together to work as expected. The cost goes around $10000-$20000 depending upon the features.

4. Testing: Before launching the app to users this step is about testing every feature for every circumstance. The cost varies from $4000-$5000.

Once these phases are done, the software is expected to perform well without any bugs. The most efficient way to get ERP development for Banking and Finance is to outsource your requirement to a full-fledged Custom Software development company. The overall cost of developing ERP in Banking sector can go around $30,000 – $60,0000.

Reading Recommended- How to Make an ERP System for the Education Industry?

Wrap up

Without a financial module, an ERP framework would not work in how it is expected to work. The highlights laid out in this article are the norm and mainstream ones; you can generally add further developed abilities if you like.

Our ERP Software Solution programming for the banking area conveys the necessary dependability and security with no issue and high costs. The rise of demand for ERP in bank industry is because of its benefits that are helping Banks become efficient every day.

Consulting Whiz, our organization has rich involvement with making ERP frameworks for different groups including banks, with extensive experience in the software development company in USA We have some utilization cases with driving public and worldwide organizations for which we have planned and dispatched:

- Comprehensive information stockrooms with start to finish streams including essential instruments like general records and further developed choices, for example, business rules or COTS frameworks.

- Online financial applications for portable contraptions through which clients can get to their wallets and exchanges. We additionally have chipped away at greater undertakings for web-frameworks with the execution of individual records, credits/stores, and cash trades.

- FinTech frameworks situated in the cloud or conveyed to customers’ workers. These ventures were centered around bookkeeping, examination, and information representation with an undeniable degree of computerization.

Mike is the founder of ConsultingWhiz LLC, Software development company in the USA, he has 15+ years of experience in agile technologies and development. I’ve worked with many satisfied owners of customer servicing businesses. Let’s connect today to get started on your path to 100% automation, reduced overhead costs, large ROI, and so much more.

Mobile App development

Mobile App development Web Development

Web Development Custom Software Development

Custom Software Development Iot Development

Iot Development

949 656 9676

949 656 9676 contact@consultingwhiz.com

contact@consultingwhiz.com